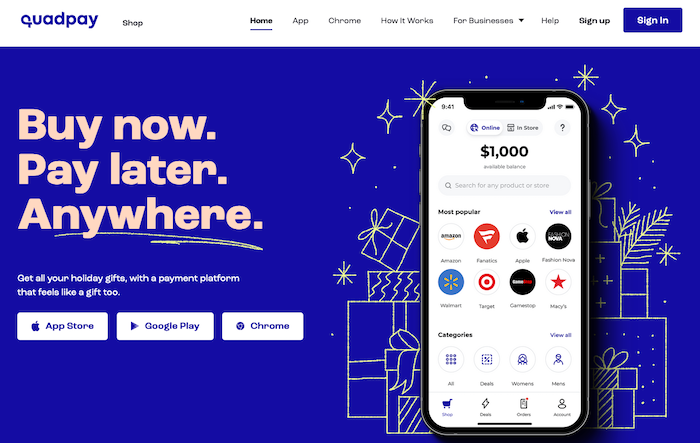

And they all got their start by partnering with merchants to embed their product in online checkout windows.īuy now, pay later startup QuadPay has now launched a new way for its users to shop at almost any store and pay for their purchases in installments as a way to grow its customer base outside of e-commerce. Over the past few years, startups like Affirm, Afterpay, Klarna, and QuadPay have come on the scene offering shoppers the option to split their e-commerce purchases into installment payments. But as merchants look toward a post-COVID world, they're looking for ways to make best use of their real estate footprints and link their in-store and online sales.īuy now, pay later startups, too, are riding this wave of connecting the online and in-store experiences. The coronavirus pandemic has caused a shift in consumer spending behavior toward e-commerce. Stripe Issuing, a self-service card issuing API, launched out of beta in April and is available to all businesses in the US.QuadPay's consumer app is powered by the $36 billion fintech Stripe.

Now, players like QuadPay have launched apps that give users the ability to shop at nearly any store and pay for their purchases in installments in-person.Buy now, pay later startups have traditionally reached online shoppers through partnerships with merchants.Account icon An icon in the shape of a person's head and shoulders.

0 kommentar(er)

0 kommentar(er)